As the economy of the country gets better, people starts traveling around the globe as tourist or for business etc. The recent statistics show that the air traffic is increasing with each year passing that is why the demand for the aircraft is also increasing consistently. As a rough estimation by economists, the number of airplanes that will be need is around 35,000 by the end of 2032. And the total worth of 35k airplanes will be around $4.84 trillion. Boeing is currently having a huge potential of growth in upcoming years, as the demand for its aircrafts are increasing with each day passing by. The BA stock price on the other hand is going to be influenced positively in upcoming years. The analysts suggest the investors to invest in BA stock because its price will surge in near future as the company’s aircrafts demand is increasing on large basis.

Month: April 2014

Best time to be a Boeing Share Holder.

The Boeing Company is the world’s largest aerospace company and manufacturing commercial airplanes. Boeing is a company that highly returns in the long term and makes the highest profit in its industry. It is expected that BA stock price will surge up to $167 in next twelve months, and it will have a very strong growth prospect. The strong future growth of Boeing has a positive correlation with the global demand for new airplanes which is increasing constantly. The estimated new airplanes demand will be around 35,000 thousand by the end of the year 2032. The value of that many new airplanes is estimated to be around $4.8 trillion. Out of 35,000 new airplanes, 14,350 will be the airplanes that will replace the older ones. The BA stock price will surge as the production and sales of the company increase in upcoming years, and the company’s share will provide better dividends than expected.

The Boeing Airplanes are in big demand all over the World.

If you want to travel faster the long distances, then only air travel can make that possible for you. It is obvious that no means of transport is available to provide you faster travel than air travel. There are train services but their networks are quite limited. The air travel is becoming more and more important considering the human beings need in today’s scenario. The demand for air craft is increasing specially in the South America, Asia Pacific, and Africa. The economists expects that the number of airplane’s to be around 35,000 thousand till the year 2032, and this can be a huge opportunity for the Boeing Company growth. There is other big corporation that manufactures aircrafts and this can increase the competition in future for the Boeing Company. In last five years, Boeing has been performing quite well, as it produced a return of 230% greater than the dividend yield of the industry.

Caterpillar: Of Lawsuits and Gold

Based out of Peoria, Illinois U.S Caterpillar Inc. is a corporation that designs, manufactures and markets machinery, engines, financial products and insurance. By gross volume of shipment Caterpillar Inc. is the largest distributor of construction and mining equipment, industrial gas turbines and diesel electric locomotives: ranked number 44 in 2009 Forbs Fortune 500 list. Operating in the open market under the stock symbol CAT, Caterpillar Inc. has a market capital and average volume of 64.71 billion and 5.78 million respectively. Founded in 1925 Caterpillar has had a profound impact on diesel and petrol locomotives and vehicular transportation used during both world wars. Looking at it from a macro perspective Caterpillar Inc. stock chart shows a significant rate of climb up until the end of fiscal year 2011 after which it largely flat lined, operating at a general stock share price of $102 per share. More recent statistics indicate Caterpillar stock has been on the rise during the first quarter of 2014 achieving its crest on the 10th of April this year.

Caterpillar stock graph and stock share prices are not just affected by the decisions taken by CAT Inc. leadership. The prices and stock performance of related, complementary goods such as gold, coal, oil and natural gas also affect Caterpillar’s earnings enormously. The recent slump in the price of gold (28%, its worst since 1981) meant tumultuous times for CAT Inc.’s mining equipment division. Revenue fell 15.5% as companies including but not limiting to Caterpillar began cutting back on capital expenditures. The overall decrease in net income negatively influenced investor interest in Caterpillar Inc. stock despite the reduced CAT stock share prices. A further testament to the degree to which outside factors influenced a company like Caterpillar Inc. is demonstrated by the fact that due to the gold slump the company had to terminate 10,000 employment contracts. In addition to the aforementioned, the fact that the U.S senate panel is initiating a corporate tax evasion investigation of the off-shore tax strategies of Caterpillar Inc. consequently reflects that CAT Inc. has not been able to leave its woes behind.

However, stock researchers such as Andrew Busch state that ruling the company out of the competition just yet would be a mistake. “This is an extremely well-run company,” Busch said in an editorial piece of The Busch Update. “This is a company that went from the 1980s when it was losing about a million dollars a day being the global leader in this pace…” Following a better-than-expected sales forecast for 2014 and announcements to enter the Chinese market have had a positive impact on investor interest in CAT stock. Analysts also see opportunities in the Asia-Pacific in general. This can be attributed to the lack of any real competing company operating in this space.

The planned expansion into Chinese markets, the expected raise in the stock price of Gold and the general direction in which the top tier management is driving the company are all reasons to expect that Caterpillar Inc. will be able to escape its predicaments by the second quarter of 2014.

Did CAT Really Evade Taxes Recently?

Caterpillar, Inc. (CAT) is a company that is engaged in the production of construction as well as mining equipment. The company also manufactures and distributes diesel and natural gas engines, diesel electric locomotives, and industrial gas turbines.

Recently, the stocks of the company hit the highest CAT stock price value in the last 52 weeks, i.e. $102.76. The raise was a direct result of the report that the U.S private jobs have risen and that China’s mini stimulus will revolutionize its economy. The stock price closed at $102.63 after the intraday trading of April 2 ended. The Caterpillar stock price therefore rose to this level by gaining almost 3% in a single day.

Recently, the company has also emerged as a stronger party amid the current Senate investigation alleging that the company has evaded overseas taxes. The company is further blamed that it has dodged more than $2.4 billion of taxes by flowing the profits to a Swiss subsidiary, which the company claims to own. The CAT officials have further defended their case by stating that they have a real business running through the Swiss subsidiary, and that is not just a tax evasion as reported to the Senate. This investigation has however nothing to do with the stock profile of the company, but if proved correct, it would then have serious repercussions for CAT.

Union pacific Corporation Announces Key leadership Appointments

Union Pacific Corporation has recently announced the appointments for key positions. The appointments were made in different departments. The highlighted departments were of Sales, Marketing, Finance and operations.

The first hiring has been of Jason Hess who will be leading agricultural product team as the vice president. He will be replacing Paul Hammes who has been associated with the company for ten years. On the other hand Hess previously had worked with National Customer Service Center.

The other appointment has been of Mike Parker who after having eleven years of successful union pacific career has now been promoted to the position of general manager in the distribution services department. Previously he was associated with the company in the position of vice president for customer communication and resource planning department. He holds a degree in Marketing from Colorado University. He also holds a Master’s degree in business administration from the famous Michigan University.

Another new appointment is of Kenny Rocker who will be working as the assistant vice president of Chemicals in the company. Previously he was working in the position of assistant vice president for Industrial product marketing.

There are many more that are lucky to start union pacific careers.

CSX Stock Price Information And Investors’ Securities about the Company

CSX Corporation (CSX) is a company based in Unites States and is primarily engaged in the transportation supply. The company offers the rail-based transportation services to its customers. These services include the traditional rail service, as well as the transportation of the intermodal containers and trailers. The investors consider this company as an emerging business that can hit the market with a greater share and grab the major percentage of sales and profits in the coming period. The investors have therefore started allying with this company so that being as shareholders they could enjoy the fruits this company will be benefitting from itself. The CSX stock price today is $29.12, which changed from the previous day price by an average of 0.52%. The 52-week high and low prices of the company’ stock are $29.44 and $22.40, respectively. The average volume of the CSX stock being traded currently is 1,585,278. The CSX stock price history suggests that the share price has increased by 3 times in the last 5 years period. Currently, the dividend yield is 2.06%, which the investors expect will increase in the prospective future. The outstanding shares at the moment are 1005.39 and total market cap is $29,276.87.

General Electric Stock Analysis

General Electric Co. or GE as it is popularly known as is one of the biggest American multinational conglomerates of today with its spread across various sectors like Energy, Technology, Finance etc. General Electric Co as we know today is credited to be founded by the discoverer of electricity, Thomas Edison. In 1892, the Edison General Electric Company merged with the Thomson-Houston Electric Company in New York, and rebranded themselves as the General Electric Co. Today, it is one of the few companies that is listed in Fortune 500 to Forbes 2000 to the Dow Jones Industrial Average.

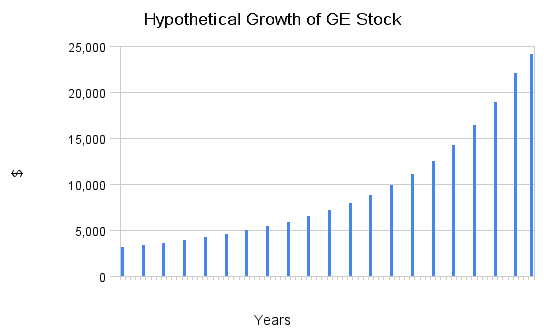

The General Electric stock had been publicly traded since 1892. The General Electric stock price saw a great surge post the industrial boom in 1960 and peaked at the dawn of the millennium to a price of $40. It saw a downturn in the 2008 global economic slowdown but has recovered since then and has attained an upward trend. Latest stock news for GE is that the company intends to bag $3.5 billion in the IPO of Consumer Finance Unit. This may see a further increase in value for the stock. The General Electric stock quote for Thursday, 27th March, 2014 was $25.81.

How tax evasion issue is going to affect CAT share price?

Caterpillar Inc. (CAT) tax evasion news is now a major area of discussion on all the financial news. It is very important topic and very hot area of debate as it is likely to affect the company in a tragic way. There is a report regarding this which says that Caterpillar has paid PricewaterhouseCoopers $55 to develop its strategy to avoid taxes. Democratic staff of committee produced this report, and it is compiled in the investigation that was held for the last nine months. The report has raised concerns about strategy of the company about taxation. But it is not accusing the producer in terms of breaching the law.

It is being speculated that Caterpillar will get support of some Republicans. It is expected that Caterpillar will get out of this. But this does not go well it will be really bad for the company, profits will go down substantially and company will lose trust of many shareholders. This can be a major dent for CAT share price. If this case goes against Caterpillar it will have to pay these taxes which will reduce the total earning, as a result of this CAT earnings will also go down

DAL stock is taking off

Delta Airlines is very well known for its cost effectiveness and customer satisfaction strategies. These are the reasons why Delta is considered as a very good company. Last year was a very good year in terms of profits for Delta. It has recorded a pre-tax income of $2.7 billion; this was a 71% increase on a year-on-year basis. This was a substantial increase and was reflected well in DELTA airline stock price. DAL stock outperformed the airline industry by quite a margin. This resulted in a big jump in share price.

In coming year top growth routes would be Middle East-Asia Pacific, within Latin America, within China and within the Asia-Pacific, including China, which are expected to show more than 6% growth. Another Major move that contributed towards the improvement of share price was reducing the debt from $17 billion to $9.3. This was a very positive sign for investors as it reduced the financial risk of the company. The interest was reduced by 35% which resulted in a substantial decrease in cost of capital. Delta Airlines by retiring a substantial amount of debt has gained confidence of its investors and this will definitely add value to the firm.